We explore your concerns, goals, and needs in retirement and gather the details of your retirement savings and income streams so we can build the foundation for your plan.

We provide you with an analysis of your portfolio and your retirement outlook (Where Do I Stand Plan). We then present the foundation of your retirement income plan.

We dive into the details of the proposed plan and provide you with our specific recommendations. If you choose to move forward, we will also begin the implementation of your plan.

To keep up with life and economic changes, we initiate quarterly reviews, communicate market updates, and our service team relays any necessary information as it relates to the status of your accounts.

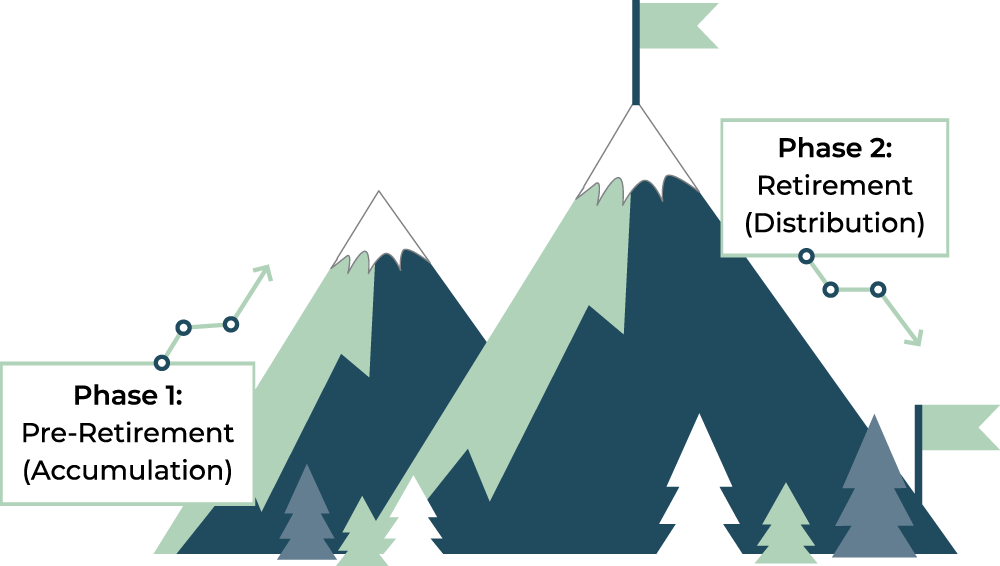

Our firm provides full-service retirement planning, addressing both Phase 1 (investment planning) and Phase 2 (income planning). From life goals to tax strategies, we put all of the pieces together into a comprehensive, written plan to help you RELAX INTO RETIREMENTSM.

We’re fluent in retirement income strategies. However, we discuss all areas of principal protection, savings, and growth potential, taking into account your entire financial picture to help ensure you make the right decisions about your financial future. We help our clients RELAX INTO RETIREMENTSM by offering services that include:

Less risk and often lower cost and fees

Serving only 55+, those preparing for retirement

Retirement is meant to be a time of enjoyment, accomplishment, and celebration. You’ve worked hard for years and now it’s time to live life on your own schedule. All your dreams and goals will still come with a price tag, but with our help, you can craft a plan that meets your goals and needs while being mindful of the nest egg you’ve nurtured throughout the years.

The idea of an investment is straightforward: You put a little bit into something now and hope to take more out of that same vehicle later. But smart and informed investing takes careful consideration. We provide the tools you need to build a solid investment strategy.

Everyone needs a strategy to maximize Social Security benefits. Many don’t have one, and there is much to consider. Whether it’s reducing taxes on Social Security benefits, suspending, deferring, or recalculating, Abich Financial can help you put together a Social Security action plan to help you optimize your benefits.

What are RMDs, and when are they required? How is the amount of an RMD calculated? How will RMDs affect your overall income plan in retirement, and how can you plan for retirement withdrawals from your nest egg? We can help you with an RMD strategy so that you can safely withdraw them and use the funds however you wish.

When you visit us and learn about our tax planning services, we create a personalized tax map for you. The new tax plan could mean new tax strategies. From helping to minimize current tax burdens to structuring a timeframe for future tax obligations, we can give you a clear picture of what to expect and help prevent unwelcome surprises down the road.

Annuities can be much more than a structured income plan. They can combine with other strategies to help you get the most out of your retirement journey. Utilizing annuities of any sort will help you develop a structured and reliable stream of income, regardless of whether or not you remain in the workforce.

A 401(k) may have been just another part of onboarding when beginning a new job throughout your career, but this account (or possibly multiple accounts) can become a big part of securing your financial goals in retirement.

For more information about retirement planning and to download your copy of the 7 Steps To Retirement handout, fill out the form below.

"*" indicates required fields