Choosing a financial professional to partner with can be a tough decision to make. After all, you’re placing a certain amount of trust in an individual or firm to help you prepare for your retirement years! Whether you’re switching from another firm or employ a DIY approach to retirement planning, we’re here to help you explore how we can step in and help in our own, unique way.

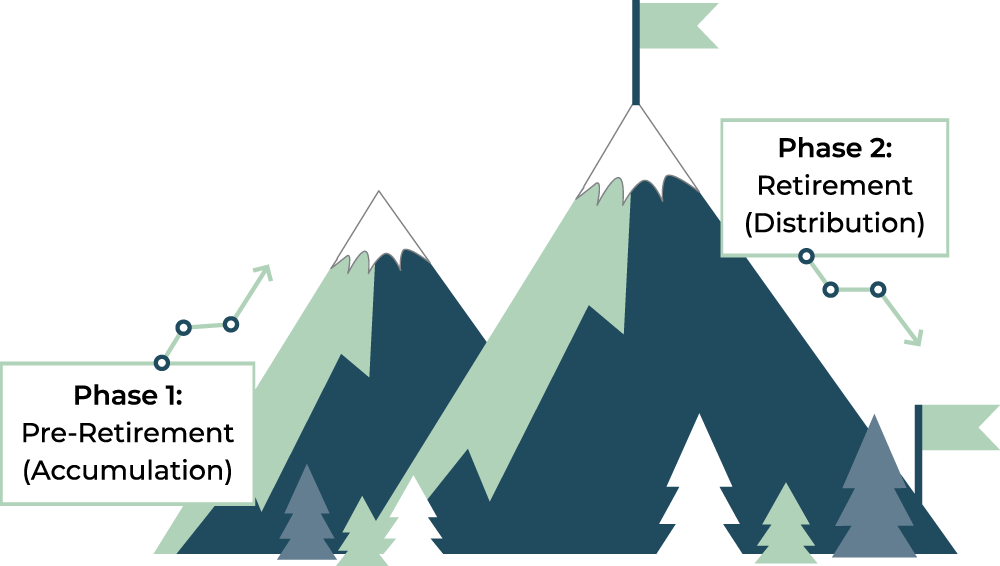

Phase 1 of Retirement Planning

Less risk and often lower cost and fees

Phase 2 of Retirement Planning

Serving only 55+, those preparing for retirement

Phase 1 of Retirement Planning

SERVE ALL AGES & PHASES OF LIFE

Managing your own investment portfolio

We get it — retirement planning can be tough. Regardless of your situation, we’d love to sit down, discuss your goals, and see if we can help fill in the gaps in your retirement plan. Fill out the form below to book your own portfolio review today!

"*" indicates required fields